7 Homeowner Responsibilities New Buyers May Not Know About

7 Homeowner Responsibilities New Buyers May Not Know About

You don’t know what you don’t know, isn’t that what they say? Oftentimes we think we’re as prepared as possible when it comes to moving into our new home, but then something comes up we didn’t even consider. Of course, your REALTOR® is there to answer all your questions and will help guide you through the home buying process itself, but if you’re just starting to think about buying, there are some responsibilities you may not realize come with being a homeowner.

We spoke with Teresa Thompson, a REALTOR® with Global Direct Realty Inc in Moose Jaw, Saskatchewan, to get her insight.

“First-time home buyers, especially those who have rented for so long, may not realize all the things they’re now going to be responsible for once purchasing a home,” Thompson admits. “Fear not! These recommendations come from personal experience transitioning from renting to owning, as well as those of friends, family members, and clients over the last several years.”

1. Maintaining your trees and yard

That big backyard or sprawling front lawn may have been a huge selling feature, but it’s now fully up to you to keep things looking nice. While it may not be a huge shock that you need to maintain the space, it’s important to know the exact parameters around it.

“Maintaining your trees is part of being a good homeowner,” Thompson says. “If the tree sits on the property line and hangs on both sides, you and your neighbour are responsible for anything in your respective yards. If the tree is on the municipality’s property, you may need to get permission from the city before maintaining it.”

Where it can get tricky is if the tree sits on your neighbour’s yard, but hangs onto your property—or vice versa. The responsibilities will depend on where you’re located. For example, in Coquitlam, British Columbia, you are not permitted to “damage your neighbour’s property (in this case a tree).” Be sure to have a clear understanding of your municipal bylaws about trees on your property.

Something else to keep in mind is most municipalities have bylaws around property maintenance. Even though you’re the one responsible for the maintenance, make sure you’re well-versed in the local expectations (especially if you have a homeowner’s association)—some municipalities have strict grass and plant heights they’ll enforce—to avoid any issues down the road.

2. Paying for garbage collection.

Yes, you pay for garbage collection when you own a home! These costs are typically included in your property taxes, but in Toronto, for example, service is on a volume-based rate structure, which is meant to encourage people to divert more waste from landfills. Collection of a small, 75-litre garbage can costs $286.69 per year while collection of an extra-large, 340-litre garbage can costs $548.26 per year. The bins are also considered city property.

If you’re moving to a rural area not covered by municipal waste collection, you’ll need to look into your options. Some areas offer “pay as you throw” systems. Homeowners can purchase bag tags based on the type of waste they’re disposing of and the city will collect it. Other options may include private waste collection companies or taking the trash to your nearest landfill by yourself. It’s not something you may think about when considering where to buy a home, but understanding garbage collection options are key.

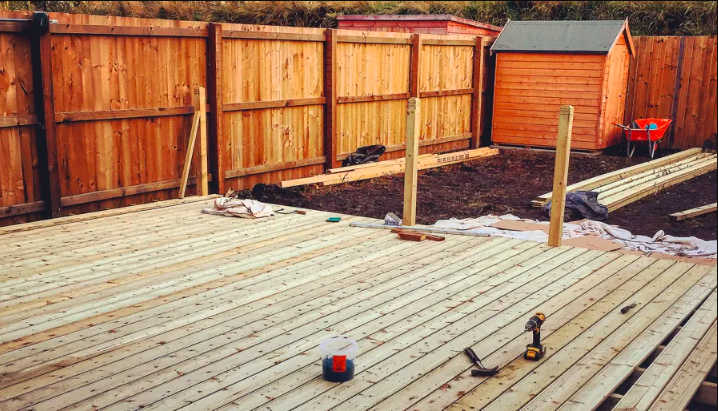

3. Getting necessary permits.

Now that you own your home, you can do whatever you want on the property, right? Wrong.

“If you plan to build a deck, garage, or fence in the near future, you will want to get a permit from the city or municipality first,” Thompson says. “Gas lines could run through your yard, and this is another reason you may need a permit; you don’t want to build on top of the gas line, so it’s good to know where this line runs.”

Even if you think the changes will be minimal, it’s your responsibility to ensure you have any and all necessary permits.

4. Clearing sidewalks in front of your home

Technically the sidewalk is city property, but it might be your responsibility to clear off the portion that crosses through your driveway. In cities like Vancouver, Winnipeg, Regina, and Edmonton, homeowners are fully responsible for clearing snow from the sidewalks in front of their home. In Calgary, homeowners have 24 hours to clear the snow from the sidewalk before you get a warning. If you don’t the city will come and do it—but send you the bill for the services.

“Clearing the snow and leaves away from your sidewalk is a big one that often gets overlooked,” Thompson says. In addition to it being law in some cities, she says “it’s [just] common courtesy for your neighbours and for your own safety.”

5. Maintaining your sewage line

The last thing you want is wastewater getting backed up or having damaged pipes that require an emergency plumber. As a homeowner, you’re not only responsible for being mindful of what’s being put down your drains, you’re also responsible for external factors that could affect your sewage line.

“If you have a lot of trees in your front yard, this may need to be done as often as once every six months,” Thompson shares. “Roots can start to grow into your sewer lines and cause blockages. I recommend my clients clean the lines a minimum of once every two years to be safe, and always ask to see video of the scoped line after the work has been done.”

As a homeowner, it’s crucial to understand your plumbing system and household water system so you can properly maintain it and know when things aren’t working the way they should.

6. Managing your finances

Okay, this is something everyone should be doing, but as a homeowner there are new levels of financial considerations you’ll need to prepare for. Thompson says “building and maintaining a budget and cash flow is the number one thing a new homeowner needs to consider.” This doesn’t just include your monthly expenses, it also means having a safety net in case of unexpected costs.

“Keeping money in a savings account for unexpected repairs is a must,” she stresses. “Remember, now that you don’t have a landlord to call on when there’s a problem, you’ll need to have a bit put away in case you need to hire a professional.”

You should also be shopping around for the best prices when it comes to services like home insurance, while still making sure it’s effectively covering you in the event you need it.

“Preparing for additional monthly expenses, such as property taxes and home insurance, should be part of your budgeting,” Thompson says. “Insurance coverage can be a lifesaver when it comes to expensive fixes (e.g. water, fire, or hail damage). Typically, the insurance companies are fairly quick with processing the claims provided you have funds saved to cover the cost of your deductible.”

7. Understanding property easements

According to the city of Ottawa, “an easement is a right held by one property owner to make use of the land of another for a limited purpose, for example as a right of passage. Easements are usually indicated on the title of a property.”

If you have a utility pole, green utility box, a catch basin, or a manhole cover on your property, or your property backs onto “utility owned land” (where there may be hydro lines, for example), workers have the right to access the property for maintenance purposes. A utility easement could also be something like a passage—it may not be a physical thing. Your lawyer should inform you of any easements as part of the home buying process.

However, it’s your responsibility to make sure any renovations or additions, such as a pool, deck, large garden, or fence, don’t interfere with the easement. If you do, it could lead to legal issues.

Becoming a homeowner is a big change, and while most of us know about the major components that come along with the journey, there are smaller things you need to keep in mind when taking on such a large responsibility. It’s why working with a REALTOR® is so important—they’ll make sure you’re taking everything into consideration and setting you up for success, not only the moment you walk through the door, but also for years to come.

You may also be interested in reading…

REALTORS® Answer the Most Googled Real Estate Questions

Real Estate Tips for Buyers from REALTORS®

First-Time Home Buyer Budgeting: What You Need to Know